What is the Marubozu Candlestick Pattern ThinkMarkets EN

Marubozo: A type of candlestick charting formation that appears when a security's price does not trade outside the range of the opening and closing prices.

Marubozu Candlestick How To Use It In Forex Trading Strategy

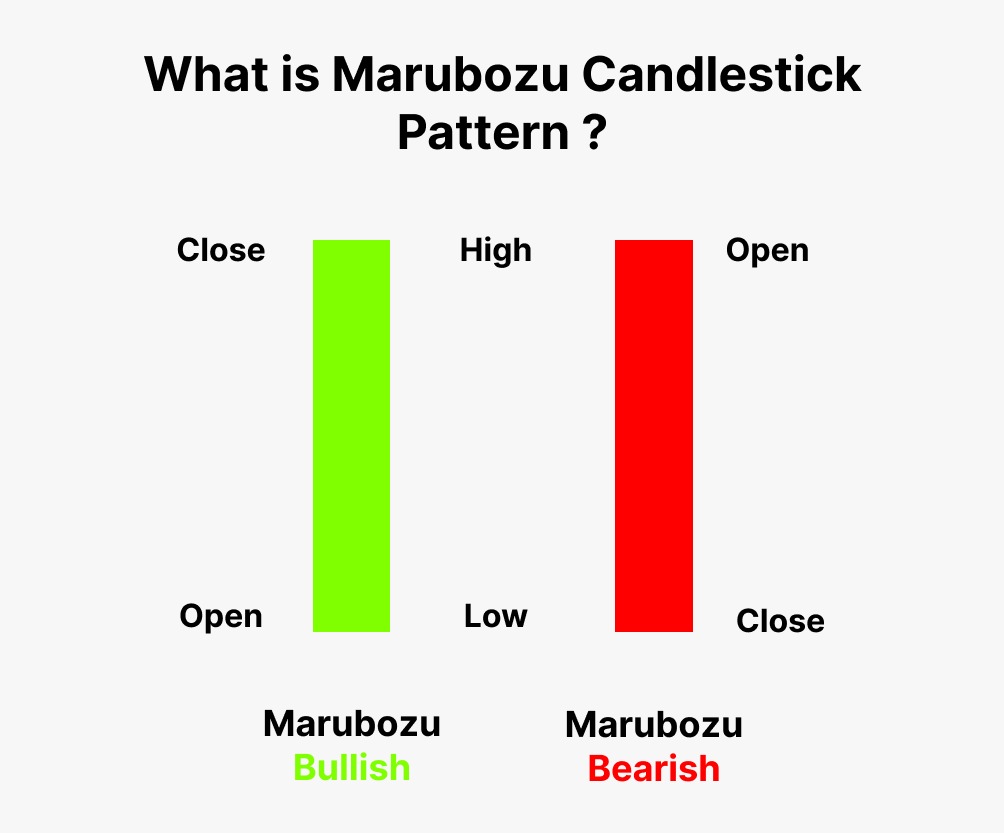

Marubozu means there are no shadows from the bodies. The word "marubozu " translates to "bald head" or "shaved head" in Japanese. So a Marubozu candlestick is a bald candle or shaved candle means it has no shadow or wick. Depending on whether the candlestick's body is filled or hollow, the high and low are the same as its open or.

Marubozu Candlestick How To Use It In Forex Trading Strategy

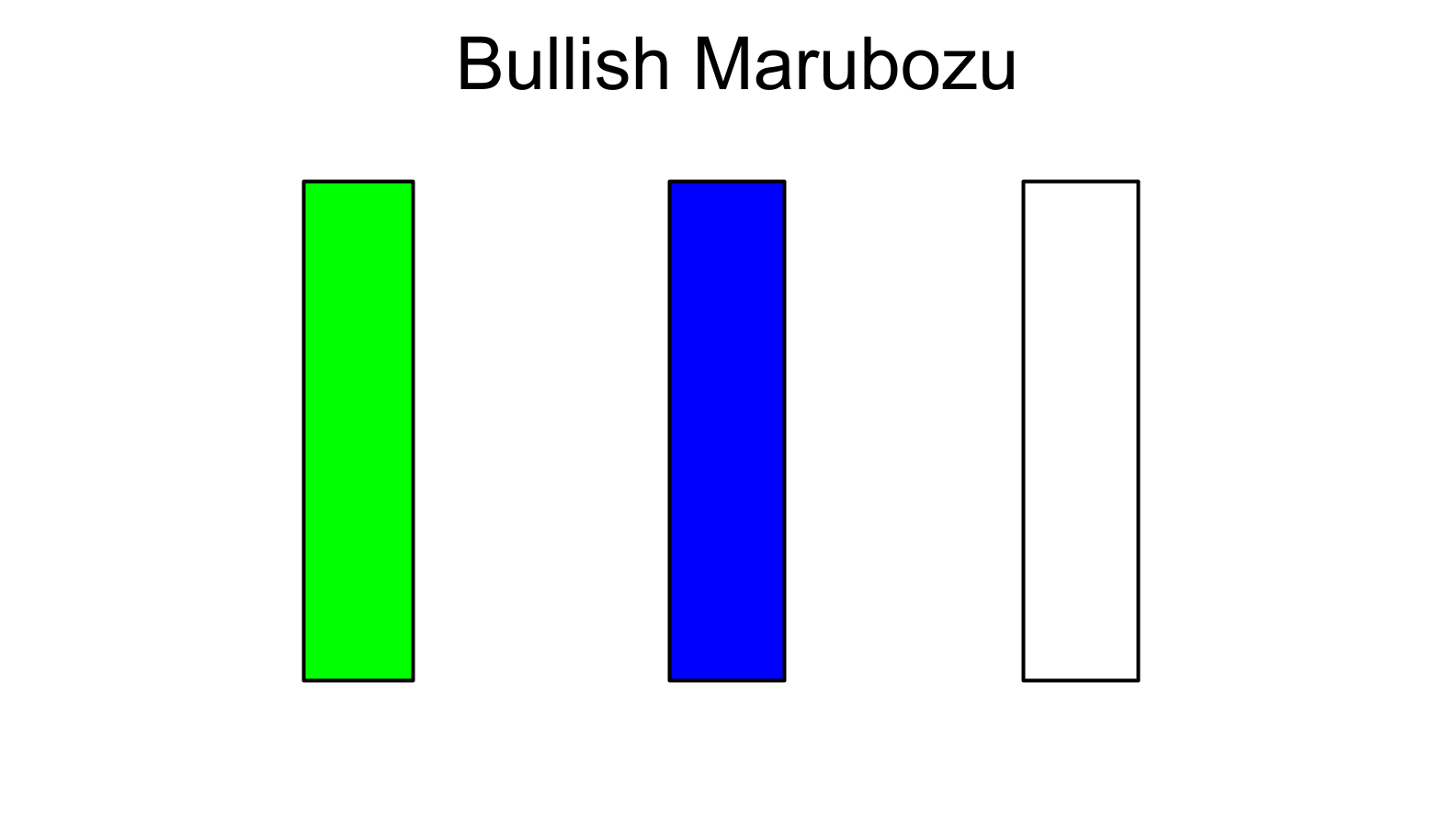

The Marubozu candlestick pattern is a single-candle formation that represents the market's resolve to move mostly in one direction without significant resistance from the opposing side, forcing a closing at the session's high or low. Marubozu comes in two varieties: bullish marubozu and bearish marubozu. Only the Marubozu candlestick.

What Is Marubozu Candlestick? And How To Trade It In Binary Options

Marubozu Candle Test Results. After conducting 4,994 trades on 1136 years of data, we confirm the superior Bearish Marubozu profit per trade to be 0.8%. A 56.1% win rate means that trading a Bearish Marubozu long will net you an average of 0.8% profit per trade if you sell after ten days. Conversely, short-selling a Bearish Marubozu, you should.

Marubozu. ¿Qué es? ¿Qué información nos da? ¿Cómo se opera?

The term marubozu means "bald head" or "shaved head" in Japanese, which implies that there are no or minimal wicks (or shadows) on the candlestick. The absence of wicks or shadow on the candlestick means that the opening and closing prices are around the same level as the high or low price for the trading session.

Price Action Candlestick Patterns 2 The Marubozu SlickTrade

Marubozu Candle: How to Trade with A Simple Candlestick. 2021-02-23 06:20:19. The Marubozu is a candlestick pattern identified when conducting technical analysis for Bitcoin, cryptocurrencies, stocks, commodities, or other price charts.It is one of the most straightforward candlesticks patterns to identify, making it perfect for those new to technical analysis.

How to Use Marubozu Candlestick Pattern to Predict the Trend Direction

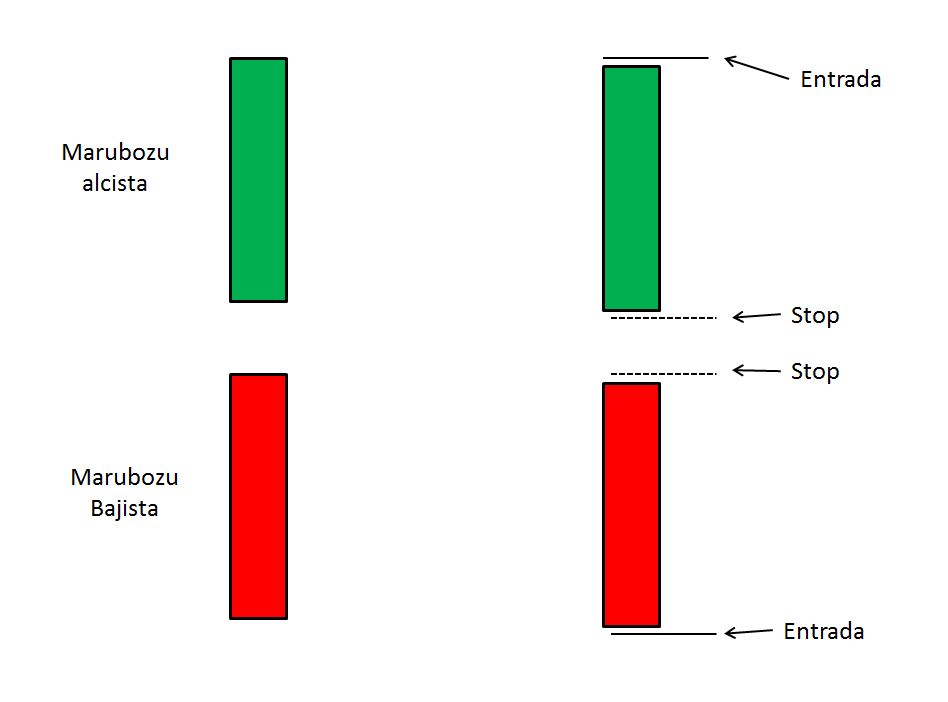

How to avoid false Marubozu signals and setting stop-loss. In most instances, the stop-loss for any trade taken on the basis of a marubozu candlestick should be low or high of the candle. Although marubozu is a strong candlestick pattern, it is wise to avoid extremely small (less than 0.5 percent range) or long candle (over 5 percent range).

What Is Marubozu Candlestick? And How To Trade It In Binary Options

The black marubozu candle on July 31, after hitting the resistance area two days prior, points to rising selling pressure and test of the July low at $28.98. If the selling continues below $28.98.

What is the Marubozu Candlestick Pattern Explained By An Expert

When Marubozu appears, it is likely that the price will develop a new trend. The length of Marubozu and the movement of the price determine the accuracy of the candlestick. For example, (A) The price continuously increases sharply => (B) Green Marubozu => There is a high probability that prices will continue to increase in the near future.

Marubozu Candle How to Trade with A Marubozu Phemex Academy

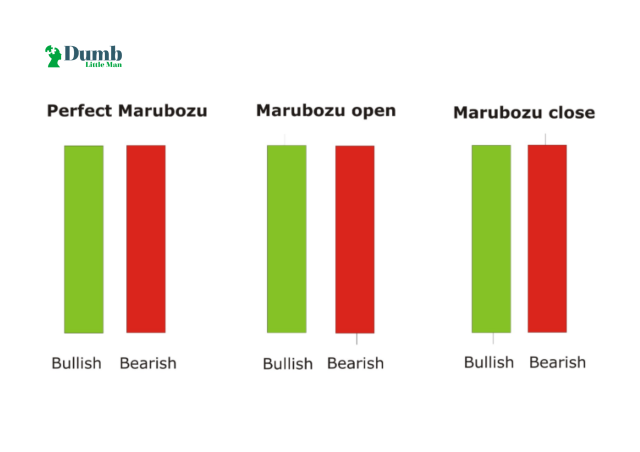

The Marubozu candlestick pattern is a single-candle bearish pattern. It is a straightforward formation that is easy to spot. In all three cases, there are bullish and bearish versions of this candle. For a pattern to be classified as a marubozu candlestick formation, at least one of the open or close has to be flat.

Candlestick Pattern The Marubozu

The Marubozu candlestick pattern is a candlestick pattern that looks like a block, meaning that it does not have any wicks (Marubozu, in Japanese, means "bald head" or "shaved head"). It is a relatively unpopular pattern but one that works relatively well when it is spotted. In this article, we will look at what the Marubozu candle is.

What is Marubozu Candlestick Pattern Meaning & Examples Finschool By

Marubozu (jp: まるぼうず, 丸坊主, close-cropped head, bald hill) is the name of a Japanese candlesticks formation used in technical analysis to indicate a stock has traded strongly in one direction throughout the session and closed at its high or low price of the day. A marubozu candle is represented only by a body; it has no wicks or.

Japanese Candlesticks Marubozu Candles

A Marubozu is a long or tall Japanese candlestick with no upper or lower shadow (or wick). The candlestick pattern comes in both a bearish (red or black) and a bullish (green or white) form and is easy to spot due to its long body. It basically looks like a vertical rectangle. To identify a Marubozu candlestick pattern, look for the following.

Marubozu Candlestick How To Use It In Forex Trading Strategy

The Bearish Marubozu pattern is composed of a candle without wicks. Meaning that its close is lower than its opening price while the high equals the opening price and the low equals the close.

Marubozu Candle Stick Trading Example

Step #1: Analyze the market context. Analyzing the market context involves figuring out if a trend is in place, and if so, its direction and strength. It is an essential first step regardless of your trading strategy. As a Marubozu is a single bar candlestick pattern, it forms in isolation. Hence, getting a firm grasp of the context becomes.

What Is Marubozu Candlestick? And How To Trade It In Binary Options

0. A Marubozu is a hard-to-miss candlestick with a full, long body and barely any shadows. This solid body indicates a strong movement in any particular direction may it be upside or downside. When a bullish green or white candlestick is formed, it indicates that the moment the price opened, they traded higher and higher, finally closing in the.